At the Berkshire Hathaway annual shareholder meeting held in May 2021, Warren Buffet stated that

State Farm is still the largest auto insurer, but I will predict that five years from now it's very likely that the top two will be GEICO and Progressive."

GEICO is a USA-based auto insurer owned by Berkshire Hathaway group, and Buffet was commenting on how he sees that GEICO stands against the competition. State Farm, Progressive, and GEICO are currently the top three auto insurers in the USA. The three players had combined $107.49Bn direct premiums written or 43% of the total market in 2020.

Now, why Buffet predicted that GEICO and Progressive would ultimately dominate the insurance industry within the next five years?

Berkshire Hathaway's Vice-Chairman of Insurance Operations Ajit Jain explained the statement a bit further:

I want to make on the issue of matching rate to risk. GEICO clearly missed the bus and was late in terms of appreciating the value of telematics. They have woken up to the fact that telematics plays a big role in matching rates to risk. They have a number of initiatives, and hopefully, they will see the light of day before, not too long, and that'll allow them to catch up with their competitors in terms of the issue of matching rate to risk.

Buffet's foresight about telematics in car insurance trackbacks to 2014 when he stated in the NYT interview:

Usage-based pricing has been favorable among firms that have tried it. There's no question that knowing how customers drive is a valuable insight into how to price the premium. Insurance is about evaluating the propensity of loss when calculating the premium.

In 2019, after resisting for years to use telematics to track driver behavior, and with the new CEO in charge, GEICO finally embraced the telematics technology and is now predicted to reach the leader auto insurer position.

Tom Wilson, the CEO of Allstate, the fourth biggest car insurer, was even more explicit:

Companies without telematics offerings' won't be in business long.

As a technology enabler, we at Mireo are witnessing firsthand this car insurance transformation since 2015. Our partners use the Mireo SpaceTime framework to build risk models from telematics Big Data and create policies that reflect how people drive instead of who they are. The telematics-based insurance programs also actively incentivize drivers to control their crash risk factors and be rewarded with lower premiums.

However, despite numerous studies and hard evidence of telematics insurance benefits to society, car insurers are transforming their businesses at a much slower pace than predicted. Matteo Carbone, founder and leader of the global insurance think-tank IoT Insurance Observatory, pointed out in a LinkedIn post:

Many players in different markets have not understood the strategic nature of this innovation. They have considered IoT adoption as an IT project or the creation of a new product... IoT adoption is a strategic choice that requires a multi-year commitment to develop the specialistic insurance IoT competencies and the leadership competencies needed to transform the way business is currently being done."

Failing to recognize that implementing a telematics insurance program is not just an IT project is entirely in line with McKinsey report where they identify three main reasons why most companies have been unsuccessful in monetizing connected car data:

- Failing to generate customer interest and differentiate their services

- Not resetting the organization

- Not establishing ecosystems for scaling

Therefore, the shift from traditional car insurance policies to telematics-based ones requires broad insurer's organizational changes that C-level people must promote, sponsor, and execute. But that change is inevitable and cannot be avoided nor prolonged indefinitely.

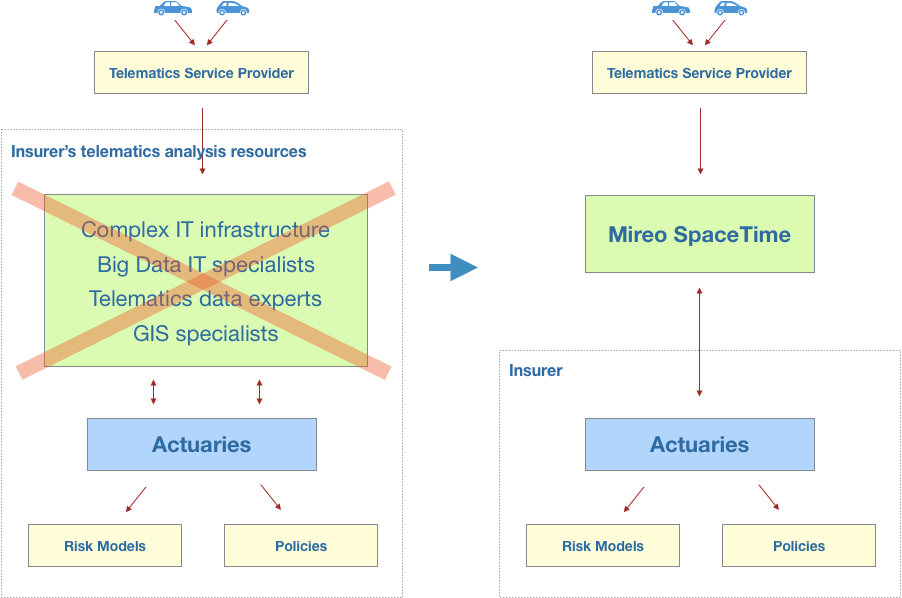

Through our experience with virtually all major insurance houses in Italy, we have recognized that one of the most prominent struggles insurers have with telematics data is the lack of expert knowledge in GPS, GIS, and Big Data Management. Analyzing information collected by telematics systems to assess individual driving risks and creating related policies requires technical expertise that insurers traditionally do not possess. Unfortunately, we've seen so many failed examples of telematics infrastructure built by insurers in-house, a task which they were never supposed to do.

Our goal here is to help insurers with Mireo SpaceTime technology to make at least the first step in telematics transformation correctly. Mireo SpaceTime completely hides the complexity of data acquisition, filtering, contextualization, and presentation from data analysts. It allows them to focus on developing risk models using tools and concepts they are already familiar with. You may learn more about Mireo SpaceTime here.

Mireo SpaceTime major benefits for insurers are:

- Analytics-as-a-Service approach to the cloud, which provides the benefits of the simplified operation and pricing

- Accelerated time to value - actuaries can access their data online without needing expert-level administration in-house, which reduces the extra management work required to make the most of the data

- Analyze petabytes of data using ANSI SQL at extreme speeds, with zero operational overhead

- An extremely cost-effective solution, requiring only about 1/10 resources compared to similar state-of-the-art solutions

In conclusion, we'll quote McKinsey once more:

Automotive connectivity is changing faster than ever, significantly increasing the potential for data monetization for players across the ecosystem. Data suppliers, such as OEMs and vehicle fleets, are well-positioned to benefit, as are insurance players, companies in the automotive aftermarket, cities, infrastructure providers, and other data customers. Importantly, all stakeholders must act fast.